2025 New England Power Grid

Supply and demand resources help meet New England’s electricity needs, and state policies are transforming the resource mix.

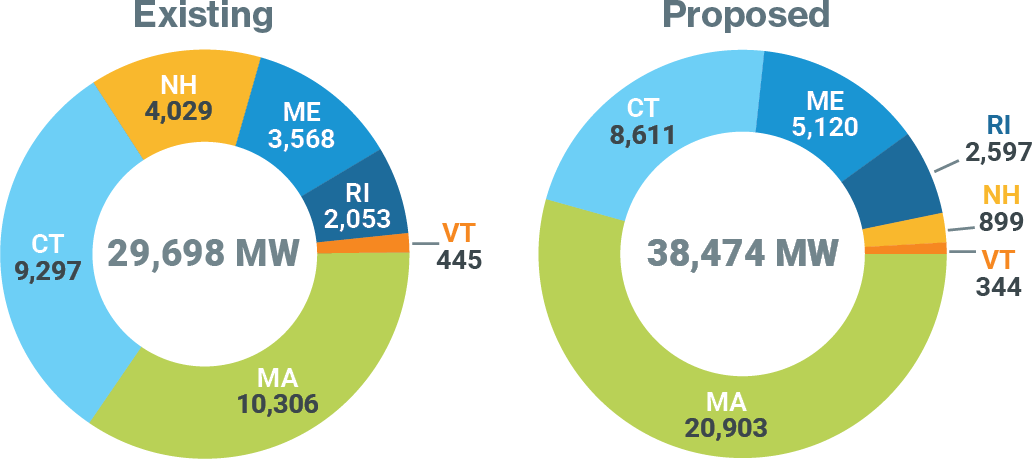

Region Has Many Proposals for New Supply

Electric generating capacity by state (MW)

Source: ISO-NE 2024 Capacity, Energy, Loads, and Transmission Report; ISO-NE Generator Interconnection Queue, January 2025

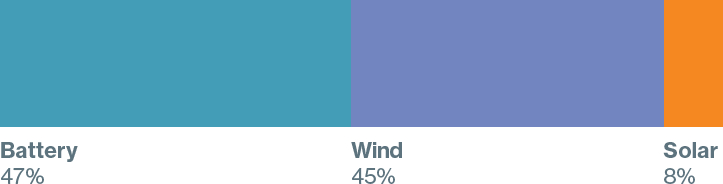

Proposed Generation (by type)

Battery storage, wind, and solar dominate new resource proposals in the ISO queue (as of January 2025); Total: 38,474 MW

Queue data represents the possible future mix of power resources in New England; however, it is a dynamic database that can change from day to day as developers submit or withdraw interconnection requests or commence operation.

The region’s capacity market is attracting investment

Around 1,928 MW of new natural gas, wind, solar, energy storage, and hydro resources have cleared in recent Forward Capacity Auctions with commitments to be available in 2025–2028.

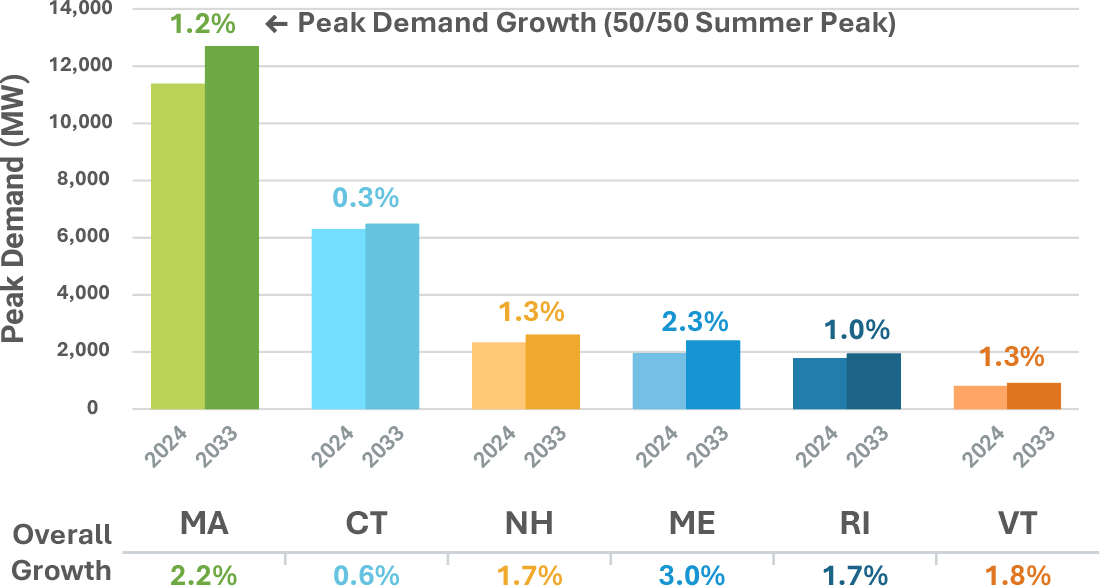

ISO’s Electrification Forecast Shows Demand Growth

Compound annual growth rates for peak demand and overall electricity use, net of energy efficiency and solar photovoltaics (PV), 2024–2033

Source: ISO-NE 2024 Forecast Data and 2024 Capacity, Energy, Loads, and Transmission Report

EE and solar PV are reducing demand growth

While state-sponsored energy-efficiency and behind-the-meter solar PV resources are driving down grid electricity use and flattening overall electricity demand in New England, the ISO forecasts that both energy usage and peak demand will increase slightly over the next 10 years. Electrification of transportation and buildings are the primary factors for this increase.

The states are active in procuring clean energy

From 2015 to 2024, Connecticut, Maine, Massachusetts, and Rhode Island have solicited more than 14,750 MW of supply through large-scale clean energy procurements, consisting primarily of wind, solar, hydro, and nuclear energy resources. This is driving proposals in the ISO queue and market participation.

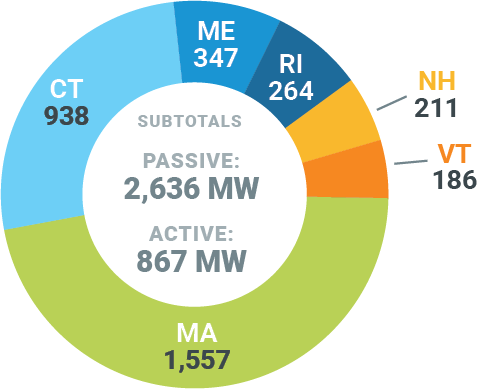

Demand Resources Compete in New England Markets

Demand resources cleared in the 16th Forward Capacity Auction and committed for June 1, 2025, to May 31, 2026 (MW)

Source: ISO-NE 2025–2026 Capacity Commitment Period Forward Capacity Auction Obligations

State Renewable Portfolio Standards Are Rising

Class I or new renewable energy resources (%)

* Vermont’s standard recognizes new and existing renewable energy and is unique in classifying large-scale hydropower as renewable.

States Target Increases in Renewable and Clean Energy and Deep Reductions in CO2 Emissions

| ≥80% by 2050 | Five states mandate greenhouse gas reductions economy wide: MA, CT, ME, RI, and VT (mostly below 1990 levels) |

| 80% by 2050 Net-Zero by 2050 |

MA clean energy standard MA emissions requirement |

| 100% by 2035 | VT renewable energy requirement* |

| 100% by 2050 Carbon-Neutral by 2045 |

ME renewable energy goal ME emissions requirement |

| 100% by 2040 | CT zero-carbon electricity requirement |

| 100% by 2033 | RI renewable energy requirement |

All six New England states have renewable energy standards

Electricity suppliers are required to provide customers with increasing percentages of renewable energy to meet state requirements.

New England states promote behind-the-meter solar PV

ISO-NE reduces the level of capacity to be procured in the Forward Capacity Auction to account for state policies promoting behind-the-meter solar PV.

New England states invest billions in energy efficiency

The six states invested nearly $7.8 billion from 2015 to 2022, and the ISO projects an additional $11 billion investment from 2024 to 2032.

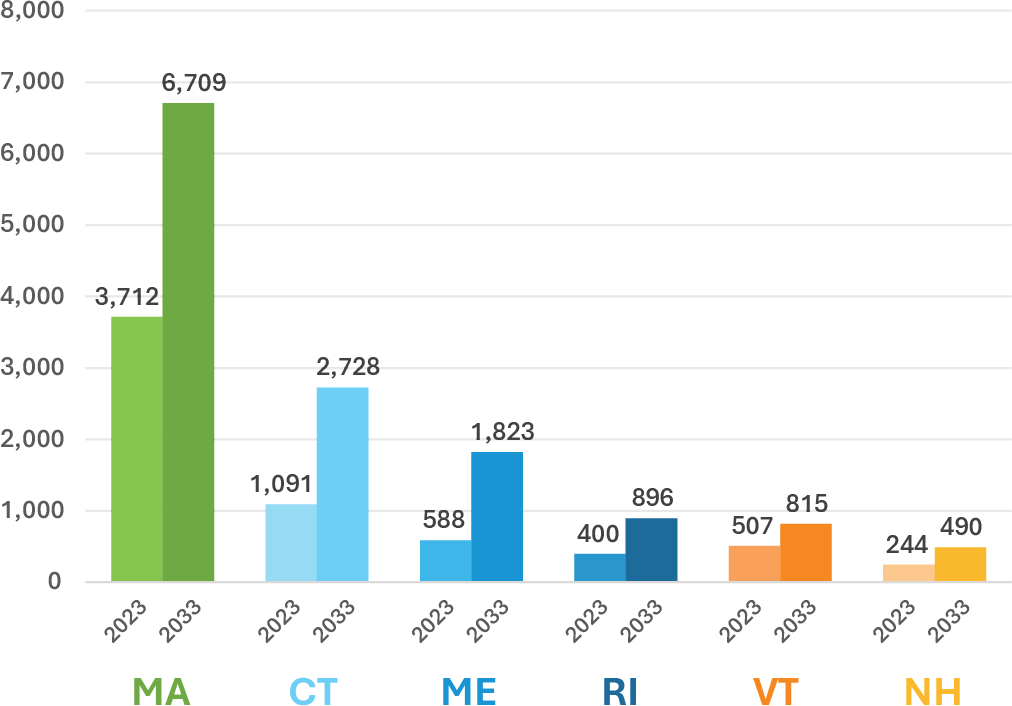

ISO-NE Forecasts Strong Growth of Solar PV Resources

Values are alternating current (AC) nameplate capacity (MW)

Source: Final 2024 PV Forecast, ISO-NE, April 2024